ChicGeek Comment The To-Wear List

Forget all this overblown hubris on buying resale, most people will be sustainable, in the short term, by simply rediscovering their own wardrobes. Regardless of size, we all have favourites we haven’t worn for a long time and are itching to get back out again. This ‘To-Wear’ list is a mental check list which grows ever longer the more we think about it. If you’re a lover of fashion, you’ll have plenty of items you can’t wait to get on your back again. Add a few future looking events and your To-Wear list keeps getting bigger and bigger.

So, if we’re busy wearing all of our old favourites, what will this mean for new fashion sales?

Admittedly, after each lock down there is a flood of pent up demand. Even this week, as the Welsh lock down ended, there were reports of long queues outside stores in the Welsh capital. One woman told BBC News she was getting it all done now in case of shop closures in the event of a return to lockdown measures. Public Health Wales' coronavirus incident director Dr Giri Shankar warned, "We do worry sometimes when we see such large number of queues outside shopping centres, outside pubs pars, cafes and restaurants.” He said we would see the effect of that “in the next couple of weeks”.

A few post-lockdown photo opportunities outside the nearest Primark and people buying necessities soon fizzles out. I’m talking about items for special events or things you love and hold on to.

The longer life takes to get back to normal, the longer our To-Wear lists become. It will be nearly a twelve months break since we wore our best clothes, add in a few extra lockdown, knockdown online purchases and we won’t need anything new for a while. Well, that’s how it feels.

While new fashion purchases could suffer while consumers work through their To-Wear lists, many people have money burning a hole in their pockets. Consumerism isn’t dead as those long queues testify.

Many people on lockdown have accumulated a lump sum of saved income to potentially splash on a once-in-a-lifetime purchase like a watch, a piece of jewellery or some art. According to data retail analysts GfK, a global leader in data and analytics, watch sales were on course for a perfect V-shaped recovery before the second national lockdown. By the end of October, the total value of sales at all price points for the whole of Great Britain over the first 10 months of the year was just 15.6% below the same period in 2019. And this was without tourist spending.

The average price paid for every watch sold in Great Britain fuelled a rise in the overall value of sales by 34.4% in October 2020. Average transaction values rocketed by 57% in the month, far higher than the increase in prices of 19.5%. Ecommerce revenue rose by 63.1% in October, up 40.3% for the 10 months since January. London saw a large lockdown bounce back in October, with sales rising by one third.

These figures clearly illustrate a demand for more expensive watches and how people are spending on considered purchases like watches even during all this turmoil. Money that would have been spent on fashion items is going into buying premium items like these. Items like watches require the confidence of having a lump sum, even just for the deposit. Lockdown has given people this opportunity.

The To-Wear list could delay the returning of fashion sales to pre-lockdown levels for a while. Many of our clothes are seasonal and we’ve missed out on nearly all four this past year. The anticipation of wearing our favourite things is an exciting prospect. The kind of items you never want to get rid of and every wear is a reminder how much you like it.

This rediscovery will be fun for a while, but then we’ll be bored again, and off it all starts, but it’s definitely something we’ve all been thinking about. We could wear them them at home, afterall, but it's not the same, Once we’ve worked through our old favourites we’ll be looking for something new, no doubt. Crazily, many of us don’t even remember what we own any more, and this could definitely propel people into thinking about what and how much they own.

What's on your To-Wear list?

Buy TheChicGeek's latest book FashionWankers - HERE

Read more expert ChicGeek Comment - HERE

ChicGeek Comment How The Jockstrap Went Mainstream

When Nike released its first branded men’s jockstrap in the middle of October it was an instant sell out. Twitter went into a digital meltdown and demand was palpable. It was the perfect product at the perfect time and was a great debut for Nike’s new men’s underwear range.

Left - The Nike Jockstrap sold out on ASOS (Nov. 2020)

The year before, in April 2019, Nike and PVH Corp. announced a new licensing agreement to design and distribute Nike branded men’s underwear worldwide. It was a natural product category extension for the nearly $40 billion a year sportswear behemoth.

“We are incredibly proud to be working with Nike, as this is an opportunity for two great companies to build on each other’s strengths, making it a win-win for everyone, especially consumers,” PVH’s Cheryl Abel-Hodges, president of Calvin Klein North America and The Underwear Group, said in a statement at the time. It also said PVH Corp.’s The Underwear Group would expand its strong portfolio which includes Calvin Klein, Tommy Hilfiger, Olga, Warner’s and True & Co.

The men’s underwear category was ripe for a tie-up with a sportswear company and their expertise in technical support, cleaning and fabrics. The new Nike jockstrap was the debut product to make a digital splash while illustrating how this traditional sports style has hit the mainstream.

Troy Daniels, @justcantstahp, says, “Nike has a jock because Calvin Klein released a jock. Calvin Klein manufacturers the underwear for Nike. So the question is actually why did Calvin Klein release a jockstrap?” he says.

“It’s because a cadre of homosexuals who work at the European Corporate Office saw the trend of niche jockstrap manufacturers exploding (Exterface, Bristle, Coyote, Darkroom, Jock, Bad Butt, Gizeppe, etc.) and thought that the world’s most identifiable underwear brand would be remiss not to have a jockstrap in their underwear portfolio. So blame it on the gays.” he says.

If the branded jockstrap at Calvin Klein hadn’t proven to be so popular, then PVH Corp. wouldn’t have pushed it as one of the first products of the new Nike license. They would have gone for something far safer. Add the huge trend of male exhibitionism, on some social media channels, and its opportunity to showcase branded underwear, and you have a huge marketing opportunity.

The jock straps roots are in sports. Wikipedia states, “The jockstrap was invented in 1874 by C. F. Bennett of a Chicago sporting goods company, Sharp & Smith, to provide comfort and support for bicycle jockeys working the cobblestone streets of Boston. In 1897 Bennett's newly formed Bike Web Company patented and began mass-producing the Bike Jockey Strap.”

Jane Garner Co-Founder of Deadgoodundies.com, an online retailer stocking the best international brands of men's underwear and swimwear, selling to customers in more than 80 countries, says, “Deadgoodundies has always stocked jockstraps. Early on designs were mostly cotton, sporty and practical, but in recent years sexy, colourful and uplifting fashion jocks have taken over and proved very popular. With DGU customers, the smaller the underwear the more popular it will be.”

Right - Polish underwear brand, Kust

Regarding the Nike launch, Garner says, “We love any brand launch that encourages men to discover and try new underwear shapes, styles and fabrics. Male shoppers are not always the most adventurous when it comes to men's underwear choices. If a guy starts wearing jockstraps as everyday underwear, rather than purely for sport or exercise, they will start to seek out the best, most comfortable and most carefully shaped designs.

“In mainstream fashion there has been a strong trend towards sporty clothing, so maybe the jockstrap's increasing popularity is part of that - not that too many men will be discussing their new undies as much as a pair of hot trainers.” she says.

The jockstrap definitely taps into the ever present sportswear category and as such is styled by many brands with trainers, caps and sports socks to illustrate this link.

Jakub Stachowiak, Founder & Owner of Kust, www.kuststore.com, a cult Polish underwear brand based in Sopot and specialising in modern and sustainable underwear, says “We do sell jockstraps. It was always one of the bestseller since we launched in 2018. Our version is minimalistic, with a wider waistband, inspired by retro aesthetic and what’s most important made of sustainable, organic cotton. We are targeting millennial + customer, who is looking for minimalistic, well designed and premium quality products.

“As the jockstraps’ origins are from sports, this is kind of matching for NIKE. Most of the brands now have a jockstrap in their offer. It has only been a few years since it became more gay and a fetish product rather than sport underwear. So it really depend how you present it in your offer.” says Stachowiak.

Versace and Armani already have jock straps in their range. For a product that is pure branding and combines sex and near nudity, it is being picked up by an increasingly younger group of male fans, particularly amongst gay men. The Nike jockstrap taps into this market while making a step into the mainstream.

Alex,@retr0fag, says, “I think that the Nike jockstrap is probably most popular amongst gay men. Jockstraps have become a staple fashion item in most gay men's underwear collection. Sportswear brands are fetishised by gay men, so it figures that a Nike jockstrap would sell very well with gay guys.”

He says, “I’m not sure why Nike would release it, whether it was a clever marketing strategy or just worked out well by chance. Exhibitionism on the internet has become quite a normal thing, with many guys posing in their underwear. And all the guys posing in their Nike jocks has heightened the appeal and made it a desirable fashion item.”

Alex P, @notorious_twub, says, “I think it’s a good idea from Nike, they’ve obviously analysed the jock market and have realised that they’re very popular with gay men. It’s a great idea as Nike’s already a pillar brand and I’m kind of surprised that it’s taken this long.

“It’s kind of putting this predominantly gay thing, which is fetishised, and bringing it to the main stream and taking the jockstrap back to its sporty origin. I’m not sure what their angle is, if it was meant to be seen as this revolutionary moment to bring jocks to the heterosexual male as a sexual look, or if it’s capitalising on a product we already know sells well and just using Nike’s brand popularity to boost sales. I feel that it’s great that a major brand are getting behind it. It’ll definitely cause some waves in the underwear industry.” he says.

Left - Men's underwear brand, Charlie by MZ, showing the connection between contemporary sportswear & the jockstrap

One thing is certain, men now knows that Nike does men’s underwear even if they're not ready for the jockstrap style . While women have had sophisticated and sexy underwear for many years, men haven’t, or have felt embarrassed about it showing off. It was a choice of boring, mundane styles or tacky, fetish type underwear. This is being readdressed by niche underwear brands, like Charlie by MZ, Kvrt Stvff and Kust, offering provocative yet cool imagery which proves to be cat nip on social media channels. The large license partners and brands have seen this and want in. They are tapping into this demand, particularly amongst young gay men.

The jock strap is an opportunity for a brand to make a splash online, but looking at Calvin Klein’s continual expansion of its jockstrap range, it must be selling. They also wouldn’t have risked producing a product for a new license partner that they didn’t think would sell well.

Thanks to social media, there is an increasing trend in demand for sexier underwear for men. By linking it back to sports will appeal to a broader range of guys. The jockstrap is now a must-have addition in any brand's underwear category. Expect brands like Tom Ford and adidas to follow.

BUY TheChicGeek's latest book - FASHIONWANKERS - HERE

ChicGeek Comment How Will Fashion Wake?

Hibernation, coma, mothballed; however you want to label it, fashion would have been in a very deep sleep before all of this is over. Even if we’re being optimistic, and life returns to a sense of normality in the spring, it would have been nearly a full year of disruption. Fashion would continue to be affected well into 2021, without fashion and trade shows in at that time to show AW22 and and we would be not fully back to normal until spring 2022 at the earliest, when the fashion cycle would have resumed.

Hibernation, coma, mothballed; however you want to label it, fashion would have been in a very deep sleep before all of this is over. Even if we’re being optimistic, and life returns to a sense of normality in the spring, it would have been nearly a full year of disruption. Fashion would continue to be affected well into 2021, without fashion and trade shows in at that time to show AW22 and and we would be not fully back to normal until spring 2022 at the earliest, when the fashion cycle would have resumed.

Left - Sleeping Beauty woke up to something good, but what about fashion?

In the classic fairytale, when the princess was cursed to sleep for a hundred years she was awakened by a handsome prince, but what will be waiting for ‘fashion’ and what state or style will it be in?

Let’s recap where we were at the beginning of this disaster. All the Kering brands - Saint Laurent, Gucci, Balenciaga - were flying. Gucci was slowing but still steaming ahead and was hopeful on becoming the world’s largest luxury brand. Bottega Veneta was gaining momentum and hype was translating into sales.

At LVMH, Louis Vuitton was still the major cash cow, Dior seemed to be doing well in sales rather than critical success and Celine was doing a stealth commercialism which, I’m sure, was being reflected in sales and exactly what Slimane was hired for and what he did previously at Saint Laurent. The main style was a mix of Gucci’s dress-up maximalism and embellishment and contemporary sportswear based on fugly chunky trainers and overpriced loungewear.

So, what can we predict for the future?

It might be worth casting an eye back in history. We’re told by the Bank of England boffins that this will be biggest recession in 300 years. Based on the bank's own best estimate and historical data, the coronavirus crisis could push the British economy into the fastest and deepest recession not seen since the huge economic slump of 1706 and the Great Frost of 1709. This was a baroque period at the beginning of Georgian Britain when fashion designers became more recognisable and fashion magazines appeared for the first time. While we’re too far away to know the minutiae of hemline changes, but it was certainly the beginning of a new era of British style and design.

The most popular comparison has been with Spanish Flu in 1918-19. After that came the Roaring Twenties, one of the most modern and dynamic decades of the 20th century. After WWII we got Christian Dior’s New Look. And while it was a feminine look back, it propelled fashion forward into the next decade and was hugely influential.

The troubles of the 1970s gave us punk and the recession of the early 90s was reflected in American Grunge.

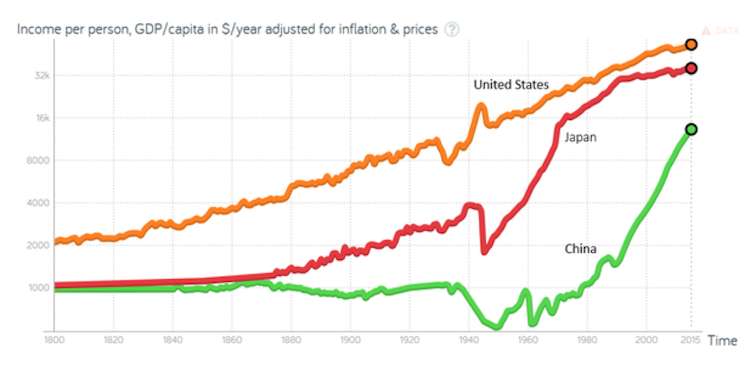

The most recent 2008 financial crash was all about the rise of China, and, undoubtedly, the growth in billon dollar brands and the associated logos and status.

Right - GDP growth of the world's three biggest economies - USA, Japan & China

While this is all simplistic, it offers some form of hope.

During the 20th century many economists cited the 'Hemline Theory'. It being the current fashion’s skirt length are a predictor of stock market direction. According to the theory, if short skirts are growing in popularity, it means the markets are going to go up.

Probably lucky everybody is wearing tracksuits right now.

And then there’s the ‘Lipstick Effect’, which is when consumers still spend money on small indulgences during recessions, economic downturns. For this reason, companies that benefit from the lipstick effect tend to be resilient even during economic downturns.

Market research firm Kline found evidence for the lipstick effect through four recessions from 1973 to 2001. Though during the financial crisis of 2008 lipstick sales dipped disproving this theory. Add a face mask and it doesn’t look like lipstick sales will be picking up anytime soon...

So, where does that leave any predictions post-COVID?

Here goes:

1) China will dominate even more. GDP Annual Growth Rate in China averaged 9.23 percent from 1989 until 2020. China’s gross domestic product expanded by 4.9 percent over the third quarter of 2020 on rising trade and consumption. According to the Wall Street Journal, it is “putting China’s economy back toward its pre-coronavirus trajectory half a year after the pandemic gutted its economy.” Brands are using China and Asia to currently support their businesses and as such more products will be tailored to these markets. China will fuel the growth in ‘Power Brands’ owned by the big groups and events like the Christian Dior, Designer of Dreams exhibition opening in Shanghai, following its success in Paris and London, will help to further educate and create this branding magic within this market.

2) Fashion will be more woke when it wakes, but the progress we were making on greening fashion will slow as many firms fight for survival and any expensive new initiatives will be put on the back burner. This is a fight for survival so we’ll see inexpensive greenwashing.

3) We’ll see a whole raft of new start-ups in the middle of next year, to launch later on that year, or in 2022. Many will be kitchen table brands with a strong and individual personality behind them.

4) Local will continue to be a focus and we’ll see more ‘luxury’ Bond Street type brands consider smaller stores in affluent neighbourhoods and design them in a less international and generic style and more of the locale.

5) They’ll be a slower reaction to the bad quality of most ‘luxury’ fashion, which will further fuel ‘fast fashion’.

On a purely aesthetic level, will people continue to want the escapist approach from brands like Gucci and what we saw during the glam 1970s downturn, or will we see a more austere and minimal look mirroring the rise in unemployment and shrinking of people’s disposable incomes? Well just have to see. Whatever happens it can't be too literal or obvious. The consumer is more sophisticated than that.

Fashion is too big now to follow the dictatorial approach of hemlines and lipsticks theories of the previous century. But, what is positive is the desire for consumption. That hasn't gone anyway. While remaining, big brands will try and monopolise for a while, we’ll see fast growing start-ups, from the most unexpected of places, give them a run for their money in a less competitive landscape which will have plenty of scope for growth due to brands disappearing.

Buy TheChicGeek's latest book FashionWankers - HERE

Read more expert ChicGeek Comment - HERE

ChicGeek Comment Have Luxury Brands Opened the ‘Daigou’ Floodgates?

Despite the unprecedented turbulence in the world’s retail markets the luxury conglomerates reported strong bounce back results this month. Both LVMH and Kering, two of the world’s largest luxury goods groups, reported extremely strong sales in the third quarter of 2020.

Despite the unprecedented turbulence in the world’s retail markets the luxury conglomerates reported strong bounce back results this month. Both LVMH and Kering, two of the world’s largest luxury goods groups, reported extremely strong sales in the third quarter of 2020.

Left - Dior AW20 - Many luxury brands no longer have limits on how much people can buy

Considering many people aren’t even leaving the house, letting alone travelling, it was surprising to see that LVMH saw sales at its fashion and leather goods division rise 12 per cent to €5.9 billion. This was much higher than market expectations and saw standout performances from the Louis Vuitton and Dior houses. The LVMH results said Christian Dior “showed remarkable momentum.” while Louis Vuitton “continued to display exceptional momentum and creativity”.

Kering too reported better than expected results. Revenue in the third quarter totalled €3.72 billion, a fall of 4.3 per cent, but representing only a decline of 1.2 per cent in comparable terms. This represented a sharp rebound after second-quarter comparable sales had plunged by 43.7 per cent.

Kering’s main cash cow, Gucci, saw revenues rise sharply in the third quarter, compared with Q2, with revenue only down 12.1 per cent, whilst retail sales were down 4 per cent on a comparable basis. Gucci reported a 43.7 per cent rise in North America and a 10.6 per cent growth in Asia-Pacific. LVMH too saw strong spending and growth in Asia and the US.

What could be behind this huge recovery surge?

Luxury companies always had a good ‘problem' in the Chinese phenomenon of ‘Daigou’. Daigou or 'Surrogate Shopping' is a term used to describe the cross-border exporting in which an individual or a syndicated group of exporters outside China purchases commodities for customers in China. Often these are luxury goods from big-name designer houses. The main reason Diagou exists is because of the price differential in the Chinese market and buying abroad is often far cheaper even after the middle men take their cut. There is a huge amount of money to be made because of the volumes and value of the goods.

Many luxury companies tried to limit the amounts sold to Diagou so as to preserve their exclusivity and not flood the market. Rarity and scarcity naturally make things more desirable. But, it appears that some of the biggest fashion houses have opened the floodgates to these buyers and organisations, no longer limiting the amounts they can purchase. Having buyers queuing up and wanting to buy as much as you can give them looks like a temptation few brands could resist as they saw their sales fall off a cliff due to COVID 19.

At the end of 2018 it was announced that Kering was ending its joint venture with Yoox Net-a-Porter and taking charge of the e-commerce for its brands including Alexander McQueen, Saint Laurent, Balenciaga and Bottega Veneta. The partnership was slated for renewal in 2020, by which time Kering’s digital operation, which looked after Gucci separately, would have, hopefully, matured to an advanced level.

While many of the world’s busiest luxury streets have been quiet since the beginning of 2020, Kering has been using its stores to process online orders rather than its warehouse in Bologna, as it had done previously.

Right - Diagou sending Dior gifts to China?

These ‘distance sales’ are up 25 to 30 per cent throughout the group and, according to an unnamed source, they are now letting the Korean and Chinese Diagou traders buy everything they want.

“The fact that the traders are now allowed to get what they want definitely helps those brands. Even at Dior, they can buy without restrictions now.” they say.

“Some companies do it everywhere. Particularly Louis Vuitton. And Dior. For the Kering Group, before the confinement, they had vague procedures that were changing depending on what items were selling. For example, for whatever reasons, some stores were selling huge amounts of the same item (usually cheaper leather goods with a logo, like pouches). When that happened, some accounts were flagged by the directors. There is a system at Kering called ‘Luce’ where you can see who bought a particular item. Every time, a trader would come, the sales assistant had to check their purchase history.

"At one point, they also checked that the credit card they use matched their profile name. (Companies would send different people who would all use the same company card. That was flagged during audits). After the confinement, every company has relaxed the procedures. I know some traders and they told me that for instance, at Gucci or Moncler, there are no limits on items purchased.

“Even Dior doesn’t do limits of items anymore. Although I hear that Louis Vuitton and Goyard still check accounts. At Saint Laurent, there is a limit of 3 of the same item per transaction. (But they can come every day and buy 3 items - they couldn’t do that before). I understand it is happening everywhere. Also, brands like Dior have resumed doing export sales. But Saint Laurent still refuse export sales unless the client has a good reason (if there is no store in their country that carries what they want to buy). It used to be a huge market for the brands until about 2 years ago when they decided to stop it all ‘to protect the markets in Asia and the Middle East’ mostly.”

Export sales are by a foreign buyer asking for it to be shipped to their territory from a store overseas. The Korean and Chinese traders often buy closer to home in other Asian markets. The Koreans are now the biggest traders selling into China.

“When they used to call stores and ask for an export sale, they would be able to have the VAT off and the European price.” says the source.

Many Daigou are or work with sales staff, using their staff discount as an extra price differential. But, it is not really possible anymore at some brands, like YSL, because they've put a limit on staff purchases. However, the limits are not imposed throughout the Kering group and Gucci doesn’t have limits. I regularly see or hear of people buying the same products. The directors have started to flag it.” says the source.

“One would think the procedures would be the same throughout the group, but it varies drastically and depends on the CEO/ Director’s decision. There are so many odd decisions though. For instance, I heard that Gucci had cancelled the VIP discounts ... which doesn’t make a lot of sense.

There are limits in the stores but not online for Kering.... which is beyond stupid. Again, something that doesn’t make sense.

There are limits in the stores but not online for Kering.... which is beyond stupid. Again, something that doesn’t make sense.

“At Kering, there is a separate online system called 'Sellsy' which is like ordering online, but through the store stock. The directors can check the accounts and stop some people from buying (if they suspect that it is for resale), but the traders can call the stores (if they cannot find items in the website) and use a different name. The credit card used cannot be checked by the stores.” says the source.

Left - Saint Laurent AW20

“Although they are starting to check the accounts again. I heard that one Korean trader got flagged and is not allowed to buy anymore. But I am sure he still does.... using various names. Some clients have more than a dozen profiles.... with same email but variations of their name. Quite surreal.” the source says.

Speaking to a Diagou reseller in China, via WeChat, they say they have direct cooperation with many of the brands, but nothing is ever ‘official’. Louis Vuitton is the best seller, followed by Dior, then Gucci. They say that COVID 19 has forced the luxury goods companies into this loose cooperation.

As for the end consumer, “Most of the clients don’t know anything about luxury. They just want to show off”. says the owner of the Diagou store on WeChat. “They don’t even have passports.”

Asked which products were most in demand at the moment and from which brands. “Every season is different. Which one is best depends how we promote.” they say.

Diagou buy and then export the goods themselves with their commission priced in. It will be interesting how the UK Tax Free shopping changes - Read more here - alters things for Daigou buying in the UK. But, then, the vast majority of reselling sales are made in more localised markets to China, hence the huge uplift in Asia.

What it does signify is the continued huge demand for named luxury goods. Which is a good sign for the industry overall.

Daigou has always been a game of cat and mouse for the brands. In one respect, this great demand is flattering for any brand, but they also want to be extremely protective of their image and how their goods are sold. COVID 19 was a massive jolt for any business and it’s understandable why many brands panicked and became more relaxed about knowingly selling to Daigou for resale into China. It could explain some of the huge bounce back in Q3 sales.

COVID created a vacuum and distorted the balance between buyer and seller. The luxury brands have turned the taps on for the Daigou market. Just don’t expect them to be on for too long.

Buy TheChicGeek's latest book FashionWankers - HERE

ChicGeek Comment Supporting Fashion’s Newness Veneer

It doesn’t take a genius to note that now is not the ideal time to launch a new fashion business. If you are launching your new business, this season, you probably started way before this disaster of a virus appeared and it was too late not to see it through. Too much time and money has been invested to pull out. You’re not a quitter.

Left - In September, MATCHESFASHION launched its The Innovators Programme to help support young designers

It’s a bit like all those cranes on the skyline and builders finishing off their dense blocks of luxury flats. It’s too late to down tools, not finish them and get them on the market. But, fast forward six months and how many spades will still be in or breaking new ground?

There will a gaping hole of projects starting and the fashion business will have one of the largest.

The V shaped, bounce-back recession is ideal because it conserves this economic momentum and it just becomes a blip. Sadly, it’s not looking that way. There is still momentum in the market, but the longer Covid disrupts everything, momentum lessens, and the more time and energy it will take to get it all moving again. This will also make this gap even larger.

Fashion has a time lag. The time between starting and producing samples, to then show, get orders, make and then sell, and then get the revenues, is usually a long timeline. It’s a risk and nobody knows what the state of the market will be when you launch, even at the best of times. Today, many of those thinking about striking out alone and setting up their own thing will choose to put off starting well into next year when they can feel more confident about the economic landscape.

Without trade shows and fashion weeks - a vehicle to showcase to buyers - many stores and websites will reorder previous years’ product, with tweaks, from existing brands. This will only really start to show when SS21 hits the stores after Christmas and consumers will start to notice.

Fashion’s reason to be is newness, or the perception of newness, and a never ending supply of new brands and designers kept the whole industry feeling fresh and new, while established brands and giant luxury groups took most of the sales and profits.

Luxury multi-brand websites and department stores need newness to give vitality to its entire offer. It’s news, it’s buzz, it’s hype and they had it all without the financial risk. This veneer or gap needs to be filled and retailers and luxury groups are now realising that they will have to start supporting it or it won’t be there.

MATCHESFASHION has launched its year-long ‘The Innovators Programme’ designed to champion young design talent. It was built upon an existing womenswear project to include menswear and is a robust package of practical support including mentorship, preferential business terms and £1.8 million in marketing.

The programme was developed as the MATCHESFASHION team collaborated closely with designers during the Covid-19 pandemic. It became clear that many of the designers were unsure how their brands could thrive through 2020 and that practical support and ongoing commitment was required. The 12 designers are: Art School, Ahluwalia, Chopova Lowena, Stefan Cooke, Germanier, Halpern, Harris Reed, Charles Jeffrey LOVERBOY, Thebe Magugu, Ludovic de Saint Sernin, Bianca Saunders and Wales Bonner. Eleven of these designers were already partner brands and each designer was chosen "for having a unique and powerful DNA which is intrinsic".

“I am delighted that we have formalised our support for emerging talent, developing The Innovators into a programme that actually helps futureproof their businesses in what has been a tough year for the creative industry. I have worked with many of these designers for a long time and I am so happy that we are committing to their visionary collections in a practical, material way.” said Natalie Kingham, Buying Director at MATCHESFASHION. This group of designers will only contribute marginally to MATCHESFASHION’s group revenues, £372 million ended 31st January 2019, but they add far more to its brand as a destination for people who love fashion and a place to discover newness and the hottest design talent. This desire is insatiable and companies need this veneer of young designers and brands. A small financial outlay is worth the newness halo effect

In 2019, Liberty launched its ‘Liberty Discovers’ platform for up-and-coming talent. It supported designers by offering mentorship from the Liberty buying team and exposure opportunities via the brand’s communication platforms and access to Liberty’s two in-house product and fabric design studios, located within its Central London store.

Right - The LVMH Prize fund of €300,000 was split amongst the 8 2020 nominees

As for all the designer prizes, many decided to split the prize monies amongst the nominees due to the pandemic. The LVMH Prize finalists, Ahluwalia, Casablanca, Chopova Lowena, Nicholas Daley, Peter Do, Sindiso Khumalo, Supriya Lele and Tomo Koizumi all shared the €300,000 prize money equally. LVMH also pledged to support previous winners of the prize with a new fund, an undisclosed amount, and the six previous winners of the LVMH Karl Lagerfeld Prize.

In America, the CFDA/Vogue Fashion Fund was renamed ‘A Common Thread’. A Common Thread has raised over $5 million of which over $2.13 million was granted to 44 businesses in the first round of funding, $2.015 million granted to 37 businesses in the second round of funding and $500,000 granted to 47 NYC-based manufacturing businesses in the third round of funding for a total of 128 recipients across the three rounds.

Fashion’s tight production timetable and traditional cashflow model makes it very difficult for small designers and brands to survive. While the giant brands and retailers want to dominate, they also want a veneer of choice and newness. Expect to see many more funds, support and ‘prizes’ to appear from the large luxury groups and retailers.

Buy TheChicGeek's new book FashionWankers - HERE

More...

ChicGeek Comment Turning 'Luxury' Consumers Back On Post COVID

Fashion is pretending everything will be alright. And it will be, eventually.

We’ve just finished the latest round of women’s fashion weeks. What would, usually, have been a month of hundreds of shows stretched between the US and Europe, was a skeleton of former schedules with international fashion councils trying to cobble together something that resembled normality and hoping by the time these clothes hit the stores they’ll be some light at the end of the COVID tunnel. Even before COVID, the traditional idea of fashion weeks and shows was being questioned yet fashion weeks seemed to continue to grow exponentially, becoming a bloated calendar of designer egos. They rarely paid their way.

Left - An underwhelming Louis Vuitton womenswear SS21 collection

What this latest round of SS21 shows did was put a spotlight on the product. Without the fashion circus; the celebs on the front row, hundreds of people pushing and hustling for a ticket, and the subsequent social media onslaught and hype, the clothes and accessorises were the main focus. Replaced by fewer brands, a socially distanced frow, if any, and, a hoped for digital audience tuning in, the product had a chance to shine. It didn’t.

A hard-to-believe audience of 5 million was supposed to have watched the much panned Nicolas Ghesquière collection for Louis Vuitton womenswear telling consumers to ‘Vote”. Seeing inside the soon-to-be-unveiled Samaritaine department store was the highlight.

Other mega brands, such as Chanel and Dior, produced critically underwhelming collections. Some brands tried to think differently though. For example, Moschino hired the Jim Henson studio to make puppets dressed in its collection and a complementary characterful front frow. While the concept was great, the clothes weren’t memorable.

It’s not so much that this season was particularly better or worse than previous seasons, it is more the fact the clothes had less distractions to hide behind. For years, fashion brands have flown everybody - press, buyers - to exotic locations or spent millions on expensive sets and concepts which have all add to the spectacle while helping to disguise the fact that many of the clothes or accessorises weren’t very good. This stripping away of the shows for SS21 has exposed what many have thought for a long time; the majority of product no longer stands up on its own.

This is a broad generalisation and there are still some great ideas in fashion, it’s too big for there not to be, but many brands rely on gimmicks, and, what I call ‘design-by-email’, which tries to squeeze as much as it can from a popular line or style. Brands milk a popular style to death. Rockstuds, anyone?

There has also been this attitude, over the last few years, that ‘brand’ is bigger than any product. As the volume of product grew, so it diluted the ideas, but the ‘brand’ got bigger. It sold, so why question it? Those inside the brands didn’t or don’t seem to be.

But, COVID has made many consumers switch off. It has made many people realise they can live without a lot of this stuff and buying new and expensive stuff was just a perpetual habit they didn’t realise they had.

If nobody can see you wearing or holding it, then what is the point? For many, there isn’t one. Also, without social events, a large proportion of fashion is redundant. Sales follow need and without the need, then want starts to wane and sales dry up. Fashion is going to need fantastic product to re-engage this dormant buying audience. Some of these consumers could be lost forever.

The formulaic fashion cycle of collabs., capsule collections and drops, put a veneer of newness onto tired products and exhausted brands. Brands need to make things that people want to shout about from the roof tops and tell all their friends about.

Quality has also become an issue. People are more likely to shout about inferior quality and poor customer service than good. They are quick to social media when complaining or pointing out issues or problems. Many consumers have started to question their last purchases from these ‘luxury’ companies and the inflated price tags for mediocre workmanship. Can they justify the prices? I wrote this last year Gucci: has it sacrificed its quality in pursuit of the quirky? It is going to have to be really good to get people who don’t feel they need something to buy again.

Right - Moschino showed its SS21 collection on puppets

The luxury brands are also humouring the resale market knowing that a strong resell value makes it easier to sell the original item. It’s becoming like the used car market.

Luxury brands need new IT bags and products. Products that stick and become classics and tropes in their repertoire of styles. For example, Dior has been pushing its Saddle bag over the last couple of years, for both men and women. It is a design with a price tag of £2,500 from over 20 years ago. Where is the new Saddle bag for that house?

Brands have become obsessed with newness, but it’s also made the whole business feel more disposable and it needs the brands to stand behind designs and give consumers the confidence to buy. Gucci has done it with its bag collections. Most have become like the fragrance market; continual launches, usurping previous versions with very few lasting more than a few years.

It doesn’t look like things will be much different come next February and March when the next round of AW21 shows are due. Fashion is reactionary but it also needs to go back to the basics of product. While it’s harder to create classic styles, they can do something about quality.

They’ll still be a physicality to showing fashion, whatever happens, and, while brands are concentrating on stemming their losses atm, post-COVID, it has to be about product, product, product. And it needs to be good.

Buy TheChicGeek's new book FashionWankers - HERE

ChicGeek Comment Turning 'Luxury' Consumers Back On Post COVID

Fashion is pretending everything will be alright. And it will be, eventually.

We’ve just finished the latest round of women’s fashion weeks. What would, usually, have been a month of hundreds of shows stretched between the US and Europe, was a skeleton of former schedules with international fashion councils trying to cobble together something that resembled normality and hoping by the time these clothes hit the stores they’ll be some light at the end of the COVID tunnel. Even before COVID, the traditional idea of fashion weeks and shows was being questioned yet fashion weeks seemed to continue to grow exponentially, becoming a bloated calendar of designer egos. They rarely paid their way.

Left - An underwhelming Louis Vuitton womenswear SS21 collection

What this latest round of SS21 shows did was put a spotlight on the product. Without the fashion circus; the celebs on the front row, hundreds of people pushing and hustling for a ticket, and the subsequent social media onslaught and hype, the clothes and accessorises were the main focus. Replaced by fewer brands, a socially distanced frow, if any, and, a hoped for digital audience tuning in, the product had a chance to shine. It didn’t.

A hard-to-believe audience of 5 million was supposed to have watched the much panned Nicolas Ghesquière collection for Louis Vuitton womenswear telling consumers to ‘Vote”. Seeing inside the soon-to-be-unveiled Samaritaine department store was the highlight.

Other mega brands, such as Chanel and Dior, produced critically underwhelming collections. Some brands tried to think differently though. For example, Moschino hired the Jim Henson studio to make puppets dressed in its collection and a complementary characterful front frow. While the concept was great, the clothes weren’t memorable.

It’s not so much that this season was particularly better or worse than previous seasons, it is more the fact the clothes had less distractions to hide behind. For years, fashion brands have flown everybody - press, buyers - to exotic locations or spent millions on expensive sets and concepts which have all add to the spectacle while helping to disguise the fact that many of the clothes or accessorises weren’t very good. This stripping away of the shows for SS21 has exposed what many have thought for a long time; the majority of product no longer stands up on its own.

This is a broad generalisation and there are still some great ideas in fashion, it’s too big for there not to be, but many brands rely on gimmicks, and, what I call ‘design-by-email’, which tries to squeeze as much as it can from a popular line or style. Brands milk a popular style to death. Rockstuds, anyone?

There has also been this attitude, over the last few years, that ‘brand’ is bigger than any product. As the volume of product grew, so it diluted the ideas, but the ‘brand’ got bigger. It sold, so why question it? Those inside the brands didn’t or don’t seem to be.

But, COVID has made many consumers switch off. It has made many people realise they can live without a lot of this stuff and buying new and expensive stuff was just a perpetual habit they didn’t realise they had.

If nobody can see you wearing or holding it, then what is the point? For many, there isn’t one. Also, without social events, a large proportion of fashion is redundant. Sales follow need and without the need, then want starts to wane and sales dry up. Fashion is going to need fantastic product to re-engage this dormant buying audience. Some of these consumers could be lost forever.

The formulaic fashion cycle of collabs., capsule collections and drops, put a veneer of newness onto tired products and exhausted brands. Brands need to make things that people want to shout about from the roof tops and tell all their friends about.

Quality has also become an issue. People are more likely to shout about inferior quality and poor customer service than good. They are quick to social media when complaining or pointing out issues or problems. Many consumers have started to question their last purchases from these ‘luxury’ companies and the inflated price tags for mediocre workmanship. Can they justify the prices? I wrote this last year Gucci: has it sacrificed its quality in pursuit of the quirky? It is going to have to be really good to get people who don’t feel they need something to buy again.

Right - Moschino showed its SS21 collection on puppets

The luxury brands are also humouring the resale market knowing that a strong resell value makes it easier to sell the original item. It’s becoming like the used car market.

Luxury brands need new IT bags and products. Products that stick and become classics and tropes in their repertoire of styles. For example, Dior has been pushing its Saddle bag over the last couple of years, for both men and women. It is a design with a price tag of £2,500 from over 20 years ago. Where is the new Saddle bag for that house?

Brands have become obsessed with newness, but it’s also made the whole business feel more disposable and it needs the brands to stand behind designs and give consumers the confidence to buy. Gucci has done it with its bag collections. Most have become like the fragrance market; continual launches, usurping previous versions with very few lasting more than a few years.

It doesn’t look like things will be much different come next February and March when the next round of AW21 shows are due. Fashion is reactionary but it also needs to go back to the basics of product. While it’s harder to create classic styles, they can do something about quality.

They’ll still be a physicality to showing fashion, whatever happens, and, while brands are concentrating on stemming their losses atm, post-COVID, it has to be about product, product, product. And it needs to be good.

Buy TheChicGeek's new book FashionWankers - HERE